What is the Multicurrency module?

The Multicurrency module allows you to operate with different currencies without having to contract a sales channel per currency.

The Multicurrency module allows you to operate with different currencies without having to contract a sales channel per currency.

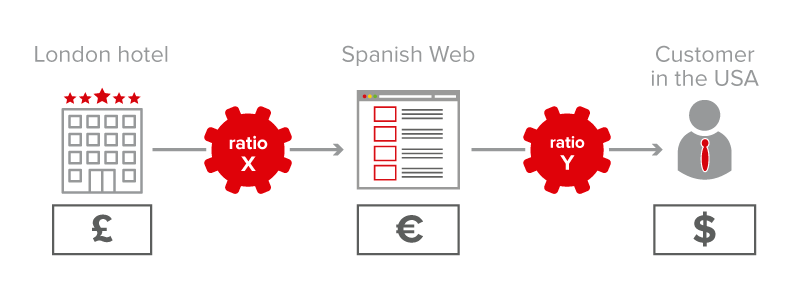

We proceed to show a simplified example of the distribution flow (purchase -sales) with different currencies:

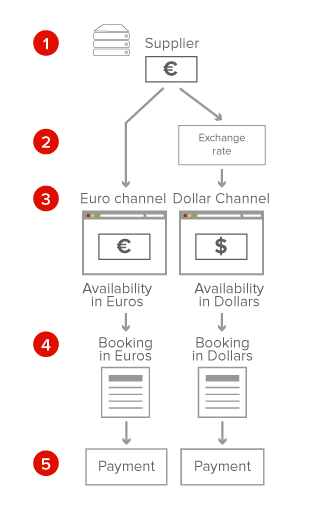

Without the Multicurrency module the system applies only one exchange rate conversion to the currency of the sales channel.

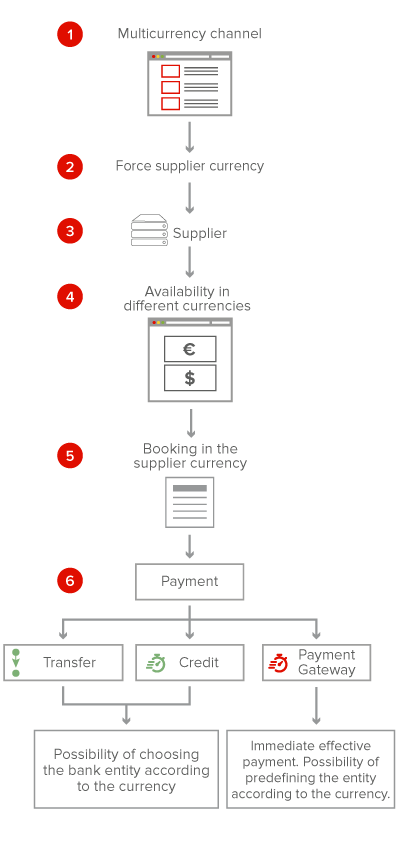

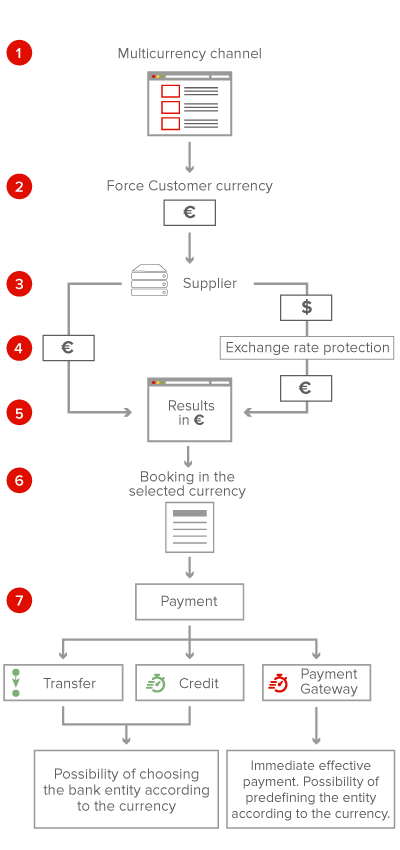

With the Multicurrency module you will be able to operate with different currencies without having to contract a sales channel for each currency. Following, we will proceed to show 2 flows with Multicurrency:

In this Flow there is no exchange rate applied.

This setting is used to return the sales price in the supplier currency, this is usually the way, where sales are being made through Webservice sales channels.

Within the same sales channel you may see each result (Availability) in the base currency of the supplier (their local currency). Therefore, in the same results you may find the same Hotel with prices in different currencies and the customer will end up paying in the currency they have previously selected for that specific offer.

In this Flow an exchange rate will apply.

This setting is used to force the sales currency as selected by the customer, independently of the currency returned by the supplier.

In this case, the End customer is who chooses the preferred currency.

The exchange rates might fluctuate either in your favor or against, due to the volatility of the currency during the time the operation lasts, therefore, there is a risk. To avoid it, there is the possibility to apply an exchange rate protection.

In Juniper we have Currency protection options, Virtual Credit Cards (VCC) and different payment gateway integration options, which you may review and check in our connections portfolio.

It is a system that allows the Juniper client to manage the volatility of the currencies with which it operates to protect its profit margin. It is particularly useful if one is not operating with the most internationally used and stable currencies. Therefore, it acts as an additional feature of the Multicurrency module (it is a Service provided by an external supplier).

It is a system to pay to the suppliers. We offer Virtual Credit Card (VCC) suppliers, which will allow you to pay at that moment in time to the supplier, automatically and through a secure payment, minimizing your administrative expenses.

It is a system to charge your customers in one or various currencies. We offer a broad payment gateway connection portfolio worldwide.